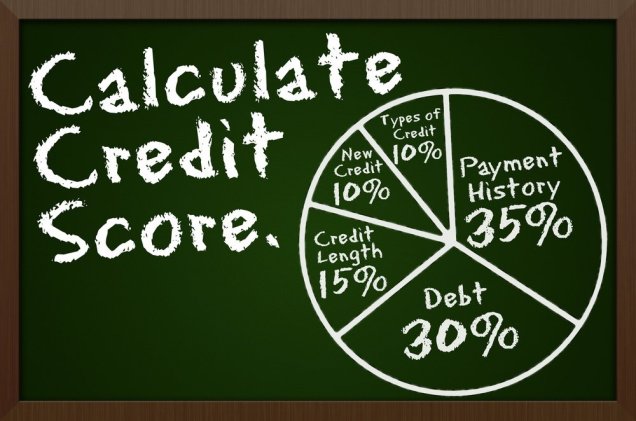

CIBIL score is based on your credit history, which plays a major role in credit card and loan approval process. Credit Information Bureau India limited (CIBIL) organizes all your credit history and presents it to the banks as credit information report. It is generally a number ranges between 300 and 900, larger the number, stronger the credit profile. CIBIL score displays your willingness and ability to repay the debt on time that is why it plays a critical role in the loan process. It may vary in different financial institutes as every bank has its own benchmarks for the CIBIL score. Do not enquire about loans at various institutes, it also negatively impacts the CIBIL score.

In order to find out your Credit Score, you can go online and refer any among many useful sites like CIBIL, CreditSmart, BankBazaar, etc. They will help you figure out your exact score and tell you whether you are eligible for any loan or not. If your CIBIL score is high then you can easily bargain with the fees involved in loan sanctioning process. Most importantly it helps in availing the loan easier and faster. Every loan applicant wants to get low-interest rates but you can get best interest rates if your CIBIL score is high. It will also guarantee you, the loan insurance products at low premiums. The good CIBIL score helps in many other aspects like easy approval for leased or rented houses and quick approval for mortgages.

If your CIBIL score is bad then it does not mean that your financial career is going to doom but it will slow you down. So you should check your CIBIL score once in a year and if it is bad due to financial decisions then you must try ways to improve your score. Below are some ways to increase the CIBIL score.

- Clear all credit card dues– plan your spending, such a way that you can clear out all your credit balances before the due date. The unpaid amount will reduce your score month-by-month so keep track of your spending. Lenders generally find the good financial history of their customers when it comes to the loan process.

- Errors in reports– sometimes errors also occur in a credit report, so one must check if their errors are appealed on CBIL website or not. This errors can occur because of typographical errors at the time of entry. It is mandatory for lenders to rectify and address the pending reports in a timeframe of a month.

- Fresh start– Mostly try to take loans after covering all your older loans or credits. It is always helpful when you start with a cleared record. Do not apply for a loan instantly at another place, after getting rejected from one place.

- Hold the old credit cards– Old credit cards with a good repayments history and well-managed spending is a blessing. Other thinks to close the oldest cards but the old cards with good repayment history help in increasing the CIBIL score. So longer you hold the positive card history, better will be the CIBIL score.

- Secured card– When someone has a bad CIBIL score then there remains the option of getting the secured card from the bank against the fixed deposit. Some leading banks like SBI, Kotak Mahindra offers secured cards against fixed deposit of nominal amounts. When you repay your balances on time it soars the CIBIL score.

- Never exceed 30% rule– While utilizing credit cards, remember the 30% rule, and do not use your credit cards more than that. It positively reflects in CIBIL score when monthly savings balance is low. Whenever your banks offer you to enhance your credit limit never refuse it as it displays bank’s trust on you. Getting enhancement in credit helps in increasing the credit score.

- Joint account criteria– If you have a joint account with someone who has taken a loan and if that person defaulted on payments then it will also affect your score. Ensure that loans and cards have been paid on time.

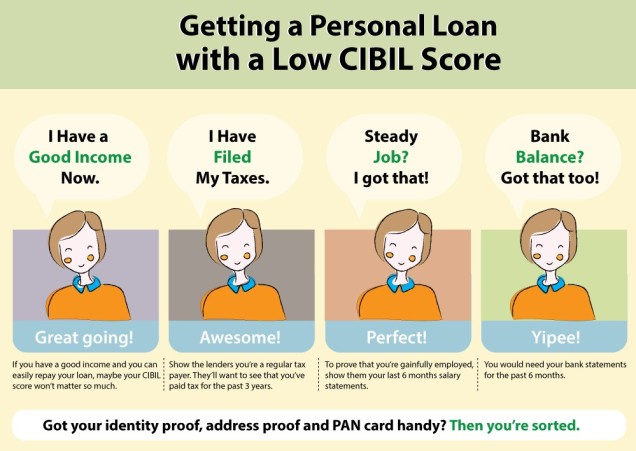

Here are some ways to get a loan in spite of having low or bad CIBIL score.

- If your CBIL score is poor then try getting a loan at co-operative banks.

- Take the loan on other person’s name whose credit rate is good. In this case, you can ask it to your close relatives whose CBIL score is good.

- Get the loan against collateral such as gold or property.

And if these are not the options for you then try other options like peer-to-peer lending or private financiers. Peer to peer lending is online marketplaces where individuals offer a loan. They are not limited to CIBIL score, you can take a loan from here if you want urgent money. Private financiers give a loan to those who are rejected from the bank but their interest rates are high.

But apart from all above, the prime fact to always consider is to maintain your financial remedies. Never overdue payments for a long time. If anytime you were unable to pay the dues for a certain month make sure to clear those in the following month so that it won’t be a headache for you as well as your credit score remains maintained in perfect grades.